Reasons to Use a Donor Advised Fund for Your Charitable Giving

Everyone has different reasons for donating to charity. Beyond the benefits to the community and the increased happiness of the donor, charitable donations are also an effective way to reduce your tax burden. Often, people tend to get so wrapped up in the why behind charitable giving that they forget about the how.

What is the best way to give to charity?

The most common and straightforward way to give to charity is to do it via cash, by writing a check or submitting credit card information. In practice, donating to charity by transferring securities (if they’ve been held for at least a year and have appreciated in value) is a more tax-efficient strategy. A Donor Advised Fund can serve as a convenient tool for this transfer.

In this insight, I’ll walk you through an example case study step-by-step. After that, we’ll consider the pros and cons of using Donor Advised Funds for charitable giving.

Donor Advised Funds in Action: A Case Study Example

Jane Burke typically donates $10,000 each year across multiple charities. She is in a combined (federal, state, local) 45% tax bracket for income taxes and 28% for capital gains taxes. She owns 1,000 shares of XYZ stock which she purchased for $2/share 20 years ago and now is trading at $40/share.

Utilizing a Donor Advised Fund provides numerous benefits to Jane as noted below. First, it is useful to describe how this type of fund works.

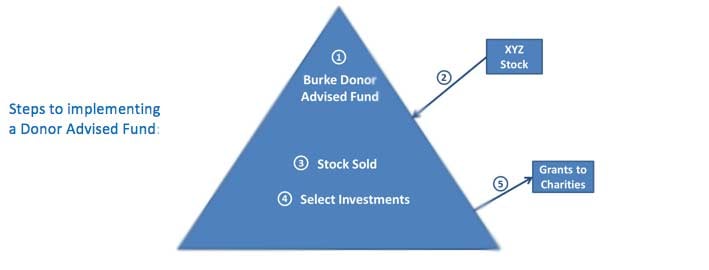

- Establish the charitable account. Fidelity, Schwab and Vanguard are some of the largest companies to offer Donor Advised Funds.

- Transfer appreciated securities to the charitable account. Let’s say that Jane transfers all 1,000 shares of XYZ stock with a fair market value of $40,000 and a cost basis of $2,000 into her Donor Advised Fund. Jane will maintain certain control noted below but the assets in the account will no longer belong to Jane. She receives a charitable tax deduction of $40,000 at the time of contribution to the Donor Advised Fund.

- Donor Advised Fund will sell the securities immediately. There is no capital gains tax assessed because the stock is in a charitable account.

- Select how to invest the assets. The mutual fund company provides a menu of models for Jane to choose from.

- Make grants to charities. Jane requests how much and to what 501c3 entities she would like to send money.

Benefits of Donor Advised Funds:

- Upfront tax deduction. Jane gets a full deduction of $40,000 when she transfers the stock, thereby reducing her taxes by $18,000 ($40,000 x 45% income tax rate), assuming no limitations or phase-outs. It is important to use stock held for longer than one year. If the stock was held for less than a year, then she would only receive a deduction on the cost basis. From a cash flow perspective, Jane has kept her cash and received an immediate deduction on the full fair market value of the stock.

- Avoid capital gain. $10,640 tax benefit. If Jane had otherwise wanted to sell and diversify herself out of XYZ stock, she would have owed capital gains tax of $10,640 (($40,000-$2,000) x 28% (capital gains tax rate)). Put another way, Jane is able to grant $10,640 more to charity by using appreciated stock rather than cash.

- Flexible timetable to make grants. She only needs to make minimal grants out of the Donor Advised Fund every couple of years. She can name a successor to take over when she dies.

- Jane no longer needs to track all of her donations for tax records. She can also stop writing checks, filling out envelopes and buying stamps. Grant requests are easy to make online or by phone.

Disadvantages of a Donor Advised Fund:

- The account administrator assesses an annualized administrative fee (generally 0.60% of assets or $100, whichever is greater) and the mutual funds charge an expense ratio.

- Jane cannot pull the assets back.

- Donor Advised Funds must start with a minimum balance, typically $5,000 but then do not need to maintain a minimum after it is established. Each grant to charities must be at least $50.

If you’re looking to sell stock at a profit and benefit from making a charitable donation, you can do both by utilizing a Donor Advised Fund. Doing this gives you the added benefit of avoiding capital gains taxes. In most cases, charitable giving via transferred securities will be your most tax-efficient option.

Looking for more guidance on charitable giving that is specific to your financial situation? Schedule a complimentary 30-minute consultation with one of our advisors today!